Overtime Pay Calculation Guide: Complete Handbook 2025

Jun 16, 2025

Last updated on Nov 13, 2025

In today's volatile business environment, mobilizing staff for overtime has become an indispensable strategic tool for meeting market demands. However, calculating overtime pay accurately according to legal regulations while ensuring compliance and optimizing labor costs remains a complex challenge. Errors in this area not only create legal risks but also seriously impact employee trust and work motivation.

Key Takeaways

- Overtime pay must be calculated using minimum multipliers of 150% (regular days), 200% (weekly rest days), and 300% (holidays), with additional allowances for night shifts

- Companies must strictly comply with overtime limits: no more than 40 hours/month and 200 hours/year (or 300 hours/year for specific industries)

- Only the portion of overtime pay above regular wages is exempt from personal income tax; the equivalent portion of regular wages remains taxable

- Overtime pay is not subject to social insurance contributions as it constitutes non-fixed income

- Organizing overtime requires employee consent, except in specific emergency situations

This article will systematize the core regulations on how to calculate overtime pay and related obligations under the current Labor Code. Mastering these rules accurately helps businesses operate confidently, avoid legal risks, and build a transparent work environment.

Fundamental regulations for calculating overtime pay in Vietnam

Basic overtime pay regulations form the foundation that helps businesses operate legally and efficiently. These regulations not only protect employee benefits as required by law but also create a clear legal framework for business operations.

Overtime is defined as work time beyond standard hours, with strict limits. For most industries, the maximum is 4 hours/day, 40 hours/month, and 200 hours/year. Certain specific industries like textiles, footwear, and agricultural processing can extend up to 300 hours/year must submit written notification to the labor authority under the provincial People’s Committee.

The fundamental principle regarding overtime pay rates requires payment above normal wages according to specific ratios. This ensures workers receive adequate compensation for time and effort spent beyond standard working hours. Regular working hours must not exceed 8 hours/day and 48 hours/week, creating an accurate calculation basis for determining overtime hours.

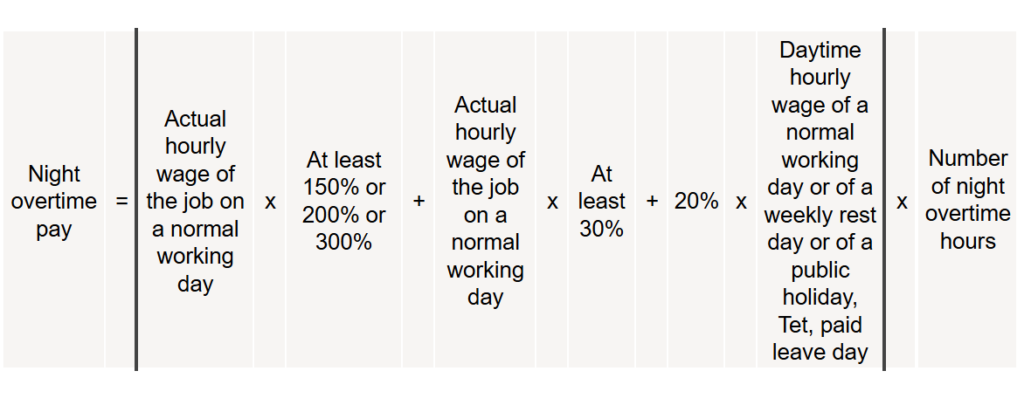

The mandatory condition for organizing overtime is obtaining employee consent regarding time, location, and specific work. Night work hours are calculated from 10 PM to 6 AM the following morning. For night overtime pay, employees receive overtime wages according to regulations (150%, 200%, or 300%), plus an additional 20% of that overtime pay, plus an additional 30% of the actual hourly wage for daytime work.

A common mistake is confusing night work hours with night overtime hours. The simple distinction: only when an employee has completed an 8-hour work shift beforehand do subsequent hours count as overtime. Understanding the regulations on overtime working hours helps businesses avoid legal violations.

How to calculate overtime pay

Applying the correct overtime pay multipliers and calculation formulas directly determines the accuracy of labor costs and employee satisfaction levels.

Basic salary multipliers

The overtime pay calculation system is built on the principle of compensating workers when they must work beyond standard hours. Applying these multipliers correctly not only ensures payroll compliance with regulations but also demonstrates fairness in HR policies.

Basic multipliers by day type:

According to Article 98 of the 2019 Labor Code, minimum overtime pay rates are calculated as follows:

- Regular day overtime calculation: 150% of actual hourly wage

- Weekly rest day overtime calculation: 200% of actual hourly wage

- Holiday overtime calculation: 300% of actual hourly wage (excluding holiday pay if the employee receives daily holiday wages)

Night work allowance:

When working at night (from 10 PM to 6 AM the following morning), employees receive at least 30% additional actual hourly wage for regular working days. This compensates for the special nature and health impact of working during biologically unfavorable hours.

Multipliers for night overtime:

- Regular day (no daytime OT beforehand): 150% x Actual wage + 30% x Actual wage + 20% x Actual wage = 200% x Actual wage

- Regular day (with daytime OT beforehand): 150% x Actual wage + 30% x Actual wage + 20% x (150% x Actual wage) = 210% x Actual wage

- Weekly rest day: 200% x Actual wage + 30% x Actual wage + 20% x (200% x Actual wage) = 270% x Actual wage

- Holidays/Tet: 300% x Actual wage + 30% x Actual wage + 20% x (300% x Actual wage) = 390% x Actual wage

When do you apply 200% versus 210% multipliers for night overtime? This point needs clarification as it relates to the continuous nature of overtime work.

Case 1 – Apply 210% multiplier: Mr. A works regular shift from 9 AM-6 PM, continues OT from 8 PM-11 PM. Mr. A will have:

- 2 daytime OT hours (8 PM-10 PM): 2h × 150% = 300%

- 1 night OT hour (10 PM-11 PM): 1h × 210% = 210%

- Total: 300% + 210% = 510% of actual hourly wage

Case 2 – Apply 200% multiplier: Mr. A works regular shift from 9 AM-6 PM, only does OT from 10 PM-11 PM (no daytime OT). Mr. A will have:

- 1 night OT hour: 1h × 200% = 200% of actual hourly wage

This 10% difference reflects the principle of additional compensation when workers must work continuously for extended periods, from day into night, causing greater impact on health and rest time.

General calculation formula

| Overtime pay based on basic salary =Actual hourly wage × Multiplier rate × Number of overtime hours. |

According to Article 55, Decree 145/2020/ND-CP, “The actual hourly wage for work being performed on a normal working day is determined by the actual salary paid for the work being done during the month, week, or day when the employee works overtime (excluding overtime pay, additional pay for night work, wages for holidays, Tet, paid leave days as stipulated in the Labor Code; bonuses as stipulated in Article 104 of the Labor Code, initiative bonuses; meal allowances during shifts, gasoline, telephone, travel support, housing allowances, childcare and child-rearing support; support when relatives die, when employees’ relatives get married, employee birthdays, occupational diseases, and other support and allowances unrelated to performing work or positions in the labor contract) divided by the total actual working hours corresponding to the month, week, or day the employee works overtime (not exceeding the number of normal working days in the month and normal working hours in one day, one week as prescribed by law that the enterprise selects and not counting overtime hours)”

Under Article 90 of the 2019 Labor Code, wages are defined as follows:

- Wages are the amount that employers pay employees according to agreement for performing work, including salary rates according to job or position, salary allowances, and other supplementary amounts.

- Salary rates according to job or position cannot be lower than the minimum wage.

Based on these regulations, the salary used as the basis for calculating overtime pay includes the salary rate according to the job or position stated in the labor contract, salary allowances that the enterprise and employee have agreed upon in the labor contract, which are regular in nature and associated with the work performance process (such as responsibility allowances, position allowances, etc.).

Specific calculation examples:

Basic information: Ms. B has a monthly actual salary of VND 15 million, works 22 days/month, 8 hours/day.

Step 1 – Calculate actual hourly wage:

- Total working hours: 22 days × 8 hours = 176 hours/month

- Actual hourly wage: VND 15,000,000 ÷ 176 = VND 85,227/hour

Step 2 – Calculate overtime pay for various scenarios:

Scenario 1: Ms. B works 3 overtime hours on Tuesday evening (regular day, 6 PM-9 PM)

- OT pay = VND 85,227 × 150% × 3 hours = VND 383,522

Scenario 2: Ms. B works 4 overtime hours on Sunday (6 PM-10 PM)

- OT pay = VND 85,227 × 200% × 4 hours = VND 681,816

Scenario 3: Ms. B works 5 overtime hours on April 30th (holiday, 2 PM-7 PM)

- OT pay = VND 85,227 × 300% × 5 hours = VND 1,278,405

Scenario 4: Ms. B works overtime from 8 PM-12 AM on Thursday (includes 2 night hours)

- 2 daytime hours (8 PM-10 PM): VND 85,227 × 150% × 2 = VND 255,681

- 2 night hours (10 PM-12 AM): VND 85,227 × 210% × 2 = VND 357,953

- Total: VND 255,681 + VND 357,953 = VND 613,634

Companies need to establish efficient payroll management processes to ensure accuracy in each calculation step.

Does overtime pay include personal income tax?

According to Article 3 of Personal Income Tax Law No. 04/2007/QH12, salaries, wages, and salary-related amounts are considered taxable income. However, there’s an important provision: the portion of overtime pay exceeding wages during regular working hours is tax-exempt.

Specifically, with a 150% overtime multiplier, the 100% portion equivalent to regular wages is taxable, while the 50% difference is tax-exempt. This means businesses need to prepare detailed statements of overtime hours and additional payments as valid tax exemption documentation.

An important note is that personal income tax obligations only arise when total income after deductions and exemptions exceeds VND 11 million/month for individuals without dependents. For each dependent, the deduction increases by VND 4.4 million/person.

The answer is no. According to current regulations, overtime pay is not subject to social insurance contributions because it constitutes non-fixed income paid according to actual working hours.

This regulation is based on the principle that only stable, regular income such as basic salary, salary allowances, and supplements with specific fixed amounts paid regularly serve as the basis for mandatory social insurance contributions. Overtime pay is sporadic and non-fixed, so it’s not included.

Companies should check monthly payrolls to ensure this amount isn’t mistakenly deducted for social insurance contributions, as this would violate current legal regulations.

Are there limits on overtime hours?

The law establishes strict limits on overtime hours to protect worker health and ensure balance in production and business activities.

Time-based limits:

- Daily: No more than 50% of regular working hours (maximum 4 hours for 8-hour workdays), total time not exceeding 12 hours/day

- Monthly: No more than 40 hours/month

- Annual: No more than 200 hours/year (300 hours/year for specific industries)

Special cases apply to certain specific industries like textiles, footwear, and agricultural processing, which may extend overtime up to 300 hours/year. However, the mandatory condition is notification to and approval from provincial labor management authorities.

The mandatory condition regarding employee consent is strictly regulated. Companies must have clear agreements on time, location, and overtime work. Only emergency cases related to national security, natural disasters, or epidemics are exempt from this condition.

To avoid common payroll process errors, companies need to establish strict monitoring systems for each employee’s overtime hours.

Accurate overtime pay calculation is not only a legal compliance obligation but also demonstrates transparency and respect for workers. Ignoring these regulations can lead to legal risks and negatively impact employee morale. Talentnet provides professional payroll services to help businesses ensure compliance and optimize costs, while offering detailed guidance on pay regulations for efficient business operations.

Solve your HR problems!

6th Floor, Star Building, 33 Mac Dinh Chi, Saigon Ward, Ho Chi Minh city, Vietnam