Labour Regulations Update in July 2025

Jul 28, 2025

Last updated on Jul 30, 2025

All information in this document is for reference and general guidance only. It is not an official advice for specific case.

Official Letter No. 1521/BHXH-TCCB on the implementation of Decision No. 2286/QD-BTC regarding functions, duties, powers, and organizational structure of Vietnam Social Security (VSS)

On 9th July 2025, Vietnam Social Security (VSS) issued Official Letter No. 1521/BHXH-TCCB to implement Decision No. 2286/QD-BTC dated 30th June 2025, amending and supplementing several articles of Decision No. 391/QD-BTC regarding the functions, duties, powers, and organizational structure of VSS.

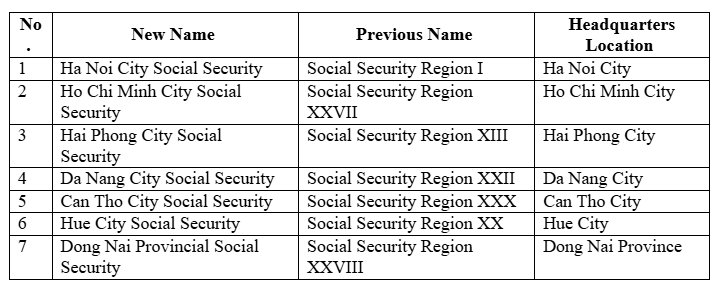

Accordingly, the names of the Social Security agencies in some major cities and provinces have been changed as follows:

Names of district-level Social Security branches (at the district, town, and city level) will be renamed as “Basic-level Social Security” (details in Appendix 2 of the Official Letter).

With this renaming, Talentnet advises clients to take note on related information in payment documents, correspondence, and reports involving these Social Security agencies.

On 25th June 2025, the Government issued Decree No. 158/2025/ND-CP providing detailed regulations and guidance on the implementation of certain provisions of the Social Insurance Law regarding compulsory social insurance.

Talentnet would like to summarize some key points related to human resources and payroll as follows:

- Employees working under probation contracts, as defined in the labor law, are not subject to compulsory social insurance.

- The reference salary is an amount set by the Government used as a basis to calculate contributions and entitlements under social insurance. Until the base salary is officially abolished, the reference salary will be equal to the base salary; afterward, it must not be lower than the last base salary level.

- The salary used as a basis for compulsory social insurance contributions includes Job title/function-based salary; Salary allowances; Other fixed, regular, and clearly agreed-upon additional payments in the labor contract. It does not include performance-based or variable payments tied to productivity or quality of work. This has been previously announced by Talentnet in earlier E-newsletters.

Decree No. 158/2025/ND-CP takes effect on 01st July 2025. Please refer to the full Decree No. 158/2025/ND-CP for other contents and details.

Law on Employment 2025 – Law No. 74/2025/QH15

On 16th June 2025, the National Assembly passed Law on Employment 2025 – Law No. 74/2025/QH15, which regulates employment policies, including job creation support, labor market management, skills development, employment services, unemployment insurance, and state management.

Talentnet summarizes key highlights related to human resources and payroll:

1. Expanded coverage for Unemployment Insurance to include:

- Employees under labor contracts for 1 month or more (fixed or indefinite term), including agreements under different names but similar in nature.

- Part-time employees earning a salary at or above the social insurance contribution threshold.

- Company managers such as directors, board members, and other paid management roles.

2. The salary base for unemployment insurance includes basic salary, allowances, and other regular, stable monthly payments. The maximum salary base is capped at 20 times the regional minimum wage set by the Government at the time of contribution.

3. Workers performing jobs that directly affect their own or public safety and health must hold a National Occupational Skills Certificate. The Government also issues a list of such occupations.

Law on Employment 2025 – Law No. 74/2025/QH15 will take effect from 01st January 2026. Talentnet will provide further updates in upcoming E-newsletters.

Regulations about mid-shift meal allowances

On 28th April 2025, the Ministry of Home Affairs issued Circular No. 003/2025/TT-BNV, providing guidance on the management of labor, wages, remuneration, and bonuses in state-owned enterprises. Accordingly, Circular No. 003/2025/TT-BNV, which takes effect from 15th June 2025, officially repeals Circular No. 26/2016/TT-BLĐTBXH. This means that the regulation stipulating that the maximum lunch allowance for employees must not exceed VND 730,000 per person per month, as stated in Circular No. 26/2016/TT-BLĐTBXH, has been officially became ineffective. However, Circular No. 003/2025/TT-BNV does not provide a specific replacement ceiling for mid-shift meal allowances.

Additionally, under Decree No. 44/2025/ND-CP on managing labor and wages in State-owned enterprises (effective from 15th April 2025), mid-shift meals are provided to employees based on labor agreements, or internal company rules/regulations in accordance with the Labor Law.

According to guidance of Official Letter No. 915/BNI-QLDN1 issued by Bac Ninh Province Tax Department regarding the determination of personal income tax (PIT) liability for mid-shift meal allowances, Bac Ninh Province Tax Department has provided the following guidance: if the mid-shift meal allowance is paid in accordance with the provisions of the labor contract, collective labor agreement, or the company’s internal regulations or policies, it shall not be included in taxable income for PIT purposes. However, if the allowance exceeds the stipulated amount, the excess portion shall be considered taxable income for PIT purposes.

We recommend that you proceed based on the actual situation and current guided documents. Talentnet will continue to update if there are any further instructions from the relevant authorities regarding this matter.

Solve your HR problems!

6th Floor, Star Building, 33 Mac Dinh Chi, Saigon Ward, Ho Chi Minh city, Vietnam